|

ALL OUR SHOPS |  | |

| Pool and Garden Showers | |||

Cold Water Showers Cold Water Showers | |||

Garden Shower Parts and Accessories Garden Shower Parts and Accessories | |||

Hot and Cold Water Showers Hot and Cold Water Showers | |||

Showers Solar Heating Showers Solar Heating | |||

| Follow MPCshop | |||

Decidedly beautiful and innovative, equipped with all the accessories for their assembly, suitable for all outdoor or indoor activities. Design showers that you can place in any outdoor or indoor environment, real pieces of furniture. Discover the best stainless steel showers online with instant discount when ordering.

|

| |

| water saving bonus | ||

| water saving bonus | ||

| water bonus | ||

| water bonus | ||

| tap bonus | ||

|

Water bonus 2023 |

| |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

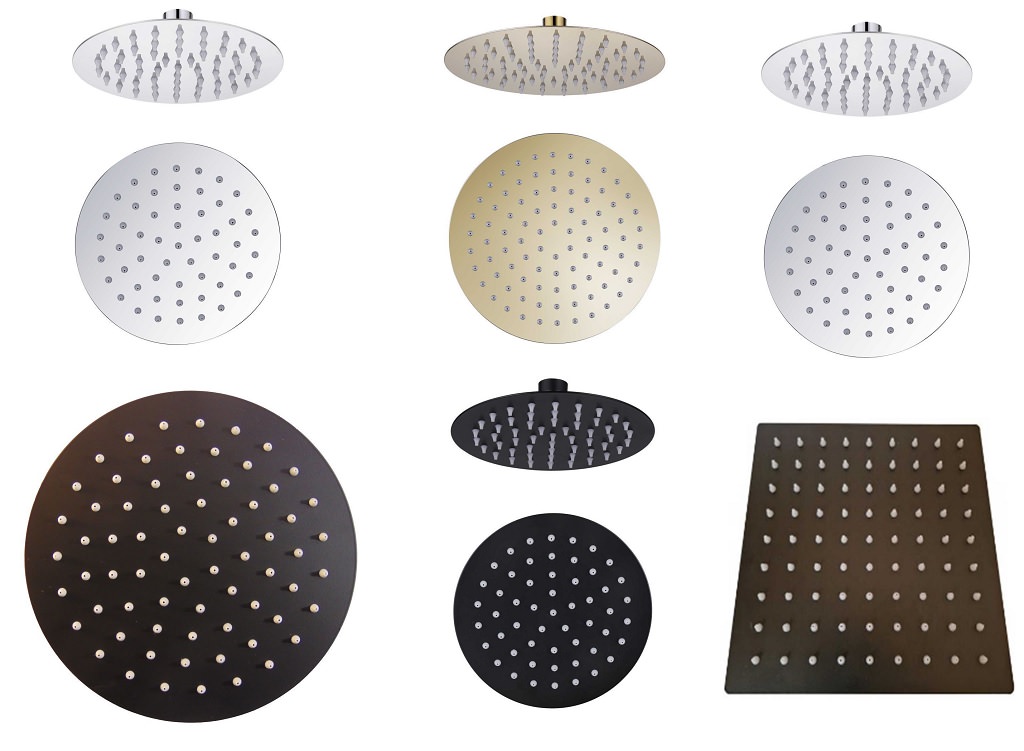

Each beneficiary is granted a water bonus up to a maximum of 1,000 euros for expenses actually incurred and duly documentedWater saving bonus what it is and how to claim it The Water Savings Bonus, also known as the Taps Bonus, consists of a reimbursement of up to €1,000 for the cost of replacing ceramic sanitary ware with new reduced-flush fixtures. The expenses eligible for the bonus are for: The reimbursable interventions covered by the shower and faucet bonus can be of various kinds and concern, for example, ceramic sanitary fixtures with a certain volume of drainage litres, including drainage works or the replacement of existing sanitary fixtures. Not only that, because we are not only talking about new purchases but also about the replacement of water flow devices, as well as showers, including shower heads and columns. Finally, the incentive includes labour costs for the change or installation of systems already in use. To be more precise, the interventions allowed under the water bonus are: Purchase and fitting of ceramic sanitary toilets, a maximum drain volume of 6 litres or less is required. Also included are works on drainage systems with masonry and plumbing works, including the cost of removing pre-existing systems; Water flow control devices (taps and mixers), both for bathrooms and kitchens, always with a flow rate of 6 litres per minute or less. Also included in this case is labour work for the decommissioning of the old systems in use; Installation of shower heads and shower columns, the water flow rate must be no more than 9 litres per minute. Any installation work is included in the reimbursement. Are our products compatible with the bonus? Sined's 316L stainless steel showers are equipped with a pressure reducer that limits the water delivery to a maximum of 9 litres per minute. They are also designed and manufactured for installation in the bathroom at home. This allows compliance with water saving regulations and certified California Cal green and Australia Watermark In Italy it allows access to the Water Bonus, which was activated in 2021 and has been extended until 31 December 2023. he water bonus, or taps, is for the purchase or replacement of sanitary fittings, showerheads and taps on existing buildings, parts of existing buildings, individual property units or buildings undergoing renovation. The maximum limit of resources allocated by the Government is €20 million, but the amount of the 2023 water bonus for each applicant is a maximum of €1,000. The water bonus cannot be claimed more than once for more than one property. At the moment, in fact, the reimbursement is only valid once for works carried out on a single property. Documents required to apply for the Water Bonus In order to benefit from the tax relief, the expenses incurred must be properly documented through the issuance by the selling company of the commercial document or electronic invoice in which the tax code of the bonus beneficiary is indicated. Also of particular importance is the method of payment, which must be made, for the purposes of acceptance, in traceable payment methods that allow the author of the payment to be traced, so it is necessary to settle the document not in cash. On the other hand, with regard to expenses incurred prior to the publication of the Measure on 16 June 2021, payments made by any method are not affected, and it is possible to supplement the commercial document or invoice by noting the tax code of the person requesting the credit. When and how to claim the bonus The communication of the amount of the expenses must be submitted through the web service available in the reserved area or the telematic channels of the Revenue Agency between 1 February and 28 February of the year following when the purchase was made. The request can be made using a form that can be downloaded from the Agenzia delle Entrate website called 'Communication of expenses for the improvement of drinking water' or by handing over the purchase invoice to your accountant, who will take care of the paperwork directly. At this point, the bonus can be used by offsetting via F24, or, for natural persons also in the tax return for the year of the expenditure and in those of subsequent years until the bonus is fully utilised. How to request it: Just go to the Agenzia delle Entrate website at this link and you will get all the useful info. Below are some of our selectable indoor showers. Below are the shower heads.

| |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| |||||||||||||||||||